How Can Dealing With An Insurance Representative Lead To Financial Cost Savings For You?

Material Develop By-Deleon Scott Have you ever before questioned just how an insurance policy agent could aid you save cash? Well, the fact is, their know-how exceeds simply locating you a plan. By diving into the intricacies of insurance coverage and using numerous discount rates, agents have the power to dramatically influence your profits. Yet that's just the tip of the iceberg. Remain tuned for more information regarding the details means an insurance coverage agent can place even more refund in your pocket.

Advantages of Using a Representative

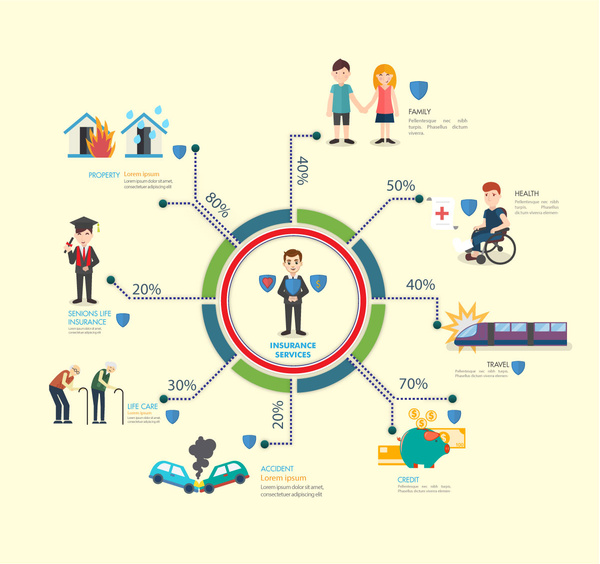

When it pertains to browsing the intricate world of insurance policy, using the know-how of an insurance policy agent can be exceptionally beneficial. A representative can assist you comprehend the ins and outs of various insurance coverage, guaranteeing you select the ideal coverage for your particular needs. Rather than spending https://www.nytimes.com/2023/05/31/climate/climate-change-insurance-wildfires-california.html researching and contrasting policies by yourself, a representative can streamline the procedure by giving personalized suggestions based upon your specific scenarios. Moreover, insurance coverage representatives usually have access to a wide range of insurance policy service providers, enabling them to help you locate the best protection at affordable costs. They can work out in your place and potentially safe discounts that you may not have been able to gain access to on your own. In addition, in case of an insurance claim, representatives can direct you through the process, answering any type of concerns and advocating for your benefits.

Making Best Use Of Plan Discounts

To guarantee you're obtaining the most out of your insurance policy, taking full advantage of offered price cuts is vital. Insurance policy agents can aid you identify and profit from numerous discounts that you may receive. For instance, bundling your home and vehicle insurance with the very same provider often causes a significant discount. Additionally, having an excellent driving record, installing safety functions in your house or auto, and even being a member of specific organizations can make you qualified for more discount rates. See to it to educate your insurance agent about any kind of life changes or updates in your circumstances, as these may open up brand-new discount rate opportunities.

Preventing Pricey Insurance Coverage Mistakes

Prevent coming under costly protection blunders by extensively comprehending your insurance policy information. One common mistake is ignoring the worth of your possessions when establishing coverage limitations. Guarantee that your plan properly mirrors the substitute cost of your belongings to avoid being underinsured in case of an insurance claim. Furthermore, stopping working to upgrade your policy regularly can lead to gaps in insurance coverage. Life changes such as purchasing a new vehicle or refurbishing your home may need adjustments to your insurance coverage to sufficiently protect your possessions. Affordable Auto Insurance is ignoring additional insurance coverage choices that might provide useful protection. As an example, umbrella insurance coverage can offer extended responsibility coverage beyond your standard policy restrictions, safeguarding your possessions in risky circumstances. Finally, not comprehending your plan exemptions can result in unanticipated out-of-pocket costs. Make the effort to examine and clarify any type of exclusions with your insurance policy agent to stay clear of being caught unsuspecting by exposed losses. By being proactive and educated, you can steer clear of pricey coverage blunders and ensure your insurance coverage satisfies your requirements. Final thought To conclude, working with an insurance representative can be a clever monetary move. They can aid you recognize policies, make the most of price cuts, and avoid pricey errors, eventually saving you cash. By leveraging their expertise and industry expertise, you can protect the most effective coverage at competitive prices. So, think about talking to a representative to guarantee you are getting one of the most worth out of your insurance coverage.